The simplified income tax rules that will come into effect from April 1 could enable a salaried person with no additional income to verify data through a pre-filled return and submit it directly, Central Board of Direct Taxes (CBDT) chairman Ravi Agrawal said on Monday.

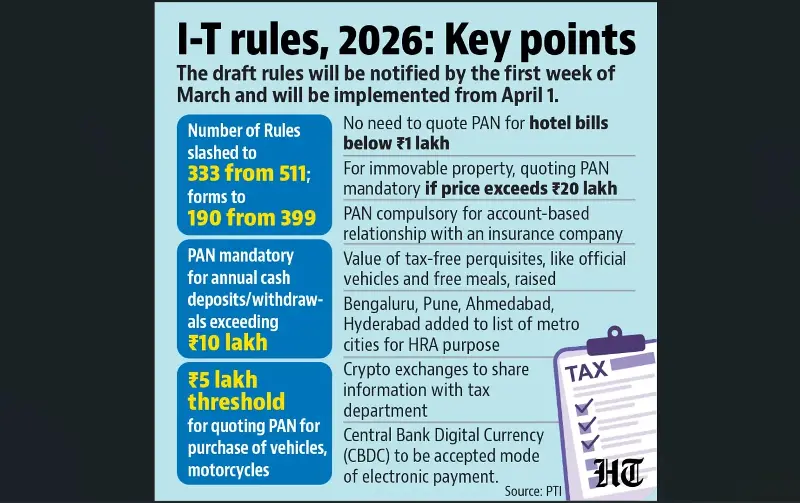

Referring to the recently enacted Income-Tax Act, 2025, he said the government has also drafted rules and forms in simple language for ease of taxpayers. Public feedback and comments have been invited before finalising the rules, which will be notified by the first week of March, he said.

Also read: Now foreign secretary Vikram Misri asked about Russian oil imports. He explains

Explaining the idea behind the new simplified rules and forms, he said: “The intent is how to cut down on redundant forms… and essentially, the focus is more on capturing the right information.” He said the exercise would not only help the Income-Tax department in analysing data, but also enhance ease of compliance. It will assist taxpayers in filing their income tax returns and ultimately help in widening and deepening of the tax base.

According to an expert, the earlier version of pre-filling (introduced around 2019-20) required taxpayers to still navigate complex ITR forms, make manual entries, and cross-verify multiple sections. This person hoped the new pre-filled forms to be simpler with the use of advance technology..

After the President gave assent to the Income-Tax Act, 2025 in August, the CBDT drafted corresponding income tax rules and forms after broad-based consultation and now it has sought feedback from stakeholders, which will be compiled and considered before finalising the notification, he said. New rules will replace the Income-Tax Rules, 1962.

Presenting the Budget for 2026-27 in Parliament on February 1, Union finance minister Nirmala Sitharaman said: “In July 2024, I announced a comprehensive review of the Income Tax Act, 1961. This was completed in a record time and the Income-Tax Act, 2025 will come into effect from April 1, 2026.”

“The simplified Income Tax Rules and Forms will be notified shortly, giving adequate time to taxpayers to acquaint themselves with its requirements. The forms have been redesigned such that ordinary citizens can comply without difficulty,” she said.